Legal Considerations for Advocacy Groups: A Comprehensive Guide

By , May 3, 2025

Overview

Advocacy groups spark change in communities and beyond, but legal hurdles can trip them up if ignored. This guide dives into the must-know Legal Considerations for Advocacy Groups, offering clear steps to stay compliant and effective. From structure to volunteers, we’ve got you covered with practical tips.

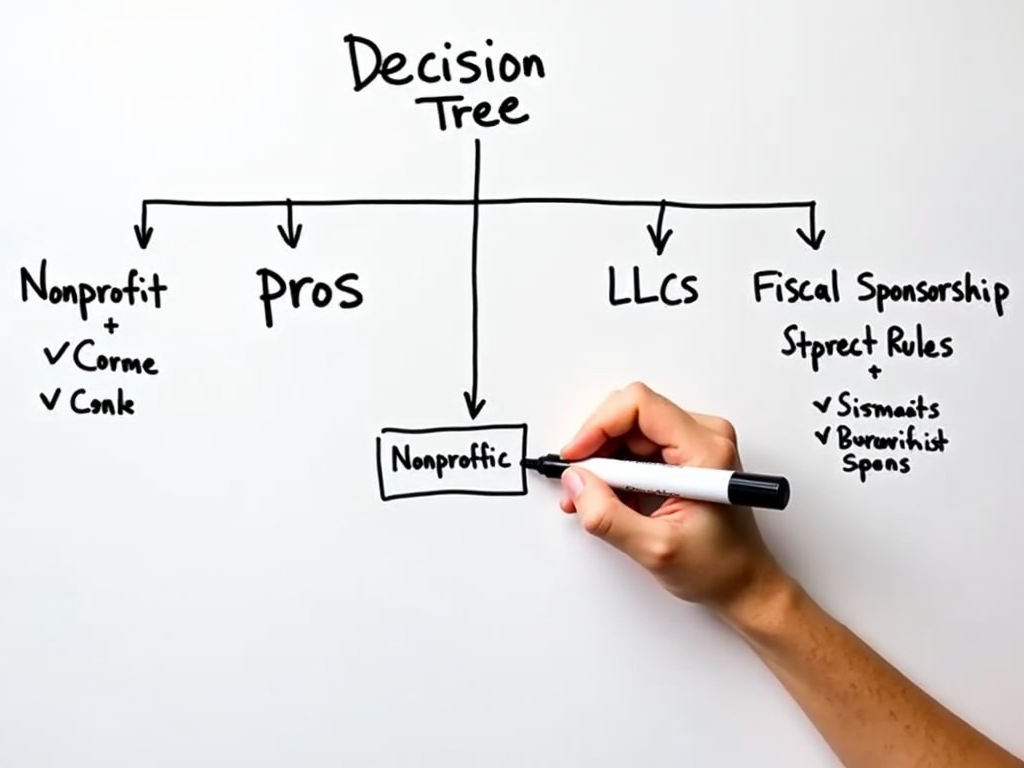

Choosing the Right Organizational Structure

Starting an advocacy group? Your first big decision is its legal setup. This choice affects taxes, liability, and how you run things. Here’s a breakdown:

- Nonprofits: Perfect for advocacy focused on education or social good. They can get tax-exempt status (like 501(c)(3)), which helps with donations. But rules limit political stuff.

- LLCs: Good if you want flexibility or plan to make money. You get liability protection, but no tax breaks.

- Unincorporated Associations: Easy to start, no formal filing. Downside? No legal shield if things go wrong.

- Fiscal Sponsorship: Team up with an existing nonprofit for tax perks without forming your own group. Less control, though.

Take 'Green Future,' a made-up group I imagine. They started casual but went nonprofit to snag grants. It worked for their eco-mission. Pick what fits your goals—chat with a lawyer if you’re unsure!

Obtaining Tax-Exempt Status

If you go nonprofit, tax-exempt status is a game-changer. A 501(c)(3) label means no federal income tax and donors can deduct gifts. Here’s how it works:

You file Form 1023 with the IRS. It’s a beast—details on your mission, board, and budget are a must. Show you’re about charity, not profit. Mess-ups like vague plans can delay approval.

'Education for All,' a fictional group, nailed it by spelling out their school equity programs. Approval took months, but it opened funding doors. Pro tip: Compare 501(c)(3) to 501(c)(4)—the latter allows more politics but no donor tax breaks. Check IRS.gov for forms and rules.

Understanding Lobbying Regulations

Advocacy often means pushing for laws, but lobbying has limits—especially for 501(c)(3) groups. Know the rules to stay safe.

- Direct Lobbying: Talking to lawmakers about specific bills.

- Grassroots Lobbying: Asking the public to push lawmakers.

You can lobby, but not too much—think 20% of your budget max. Track every dime and minute spent. 'Health Rights Now,' an imagined group, got in hot water overspending on a health bill push. They learned to log everything.

Use the 501(h) election for clear limits—it’s less fuzzy than the 'substantial part' test. State laws might differ, so double-check locally.

Compliance with Local Laws

Federal rules aren’t enough—states and cities have their say. Miss these, and you’re in trouble.

- Charity Registration: Most states demand it before you fundraise. Check your state’s site.

- Event Permits: Need a rally? Get approval first.

- Staff Rules: Paid folks? Follow wage and safety laws.

'Community Voices,' a pretend group, got fined for skipping registration in Ohio. Now they track deadlines. Assign someone to handle this—it keeps you legal and stress-free.

Protecting Intellectual Property

Your group’s name and logo? They’re gold. Guard them.

- Trademarks: Register your name/logo with the U.S. Patent and Trademark Office. Stops copycats.

- Copyrights: Protect reports or videos you make.

- Online: Grab your domain and social handles fast.

'Art for Change,' a fake arts group, trademarked their logo. It’s now their calling card. Watch for thieves—quick action like a cease-and-desist keeps your brand yours.

Volunteer Training and Management

Volunteers fuel advocacy, but you’ve got to manage them right.

- Agreements: Sign them up with clear roles and rules.

- Training: Teach your mission and laws—like privacy stuff.

- Insurance: Get coverage for accidents.

'Animal Advocates' made a handbook for their crew, covering animal laws and safety. It cut risks. Watch the Fair Labor Standards Act—volunteers aren’t staff, so don’t treat them like it. Good volunteer training for advocacy work pays off.

Wrapping It Up

Legal stuff isn’t flashy, but it’s the backbone of strong advocacy. Get your structure, taxes, lobbying, local rules, property, and volunteers sorted, and you’re set to shine. It’s not just avoiding trouble—it’s powering your cause. Dig into Advocacy Strategies for Social Change or How to Start a Community Advocacy Group next for more know-how.